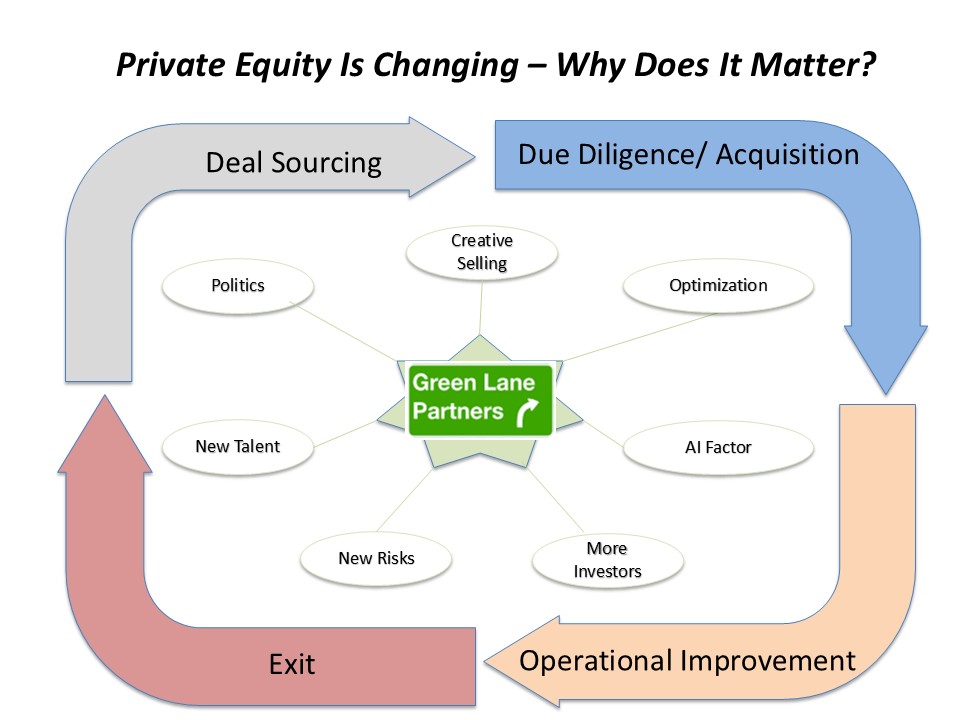

How Private Equity Is Changing — And Why It Matters

Private equity (PE) was mostly about buying companies, making them more profitable, and selling them for a gain. These days, it’s getting a serious makeover. The biggest firms are becoming more like “all-in-one” financial problem-solvers, blending different types of investments, using new tech, and finding fresh ways to help companies grow. Let’s break down what’s going on. Firstly, private equity firms diversify their portfolios by incorporating venture capital and real estate investments. This shift allows them to tap into emerging industries and technologies. Additionally, they leverage data analytics to enhance decision-making processes, driving efficiencies that benefit their investments and the companies they manage. This evolution is crucial as it enables PE firms to adapt to market changes and offer more comprehensive support to their portfolio companies.

1) More tools in the financial toolbox

What’s new:

Private equity firms aren’t just buying companies anymore. They’re also lending money directly, mixing debt and equity, and even helping their funds borrow against the companies they own. They’re using creative financing to help companies expand, make acquisitions, or give investors some money back without selling the business.

Why it matters:

It means PE firms can keep good companies longer, invest in them more, and still give investors returns along the way. This shift allows private equity firms to enhance their influence over portfolio companies while maintaining flexibility in their investment strategies. By integrating these financing options, they can better navigate market fluctuations and support long-term growth. Ultimately, this approach can create more sustainable value for companies and investors.

2) Selling is getting more creative

What’s new:

The old approach—selling to another investor or taking the company public—isn’t the only game in town. Now, they might sell a piece of the company, keep the rest, or even set up a new fund just to keep holding a strong performer.

Why it matters:

This flexibility helps PE firms wait for the right moment to sell, which can mean better prices and smoother transitions. This creative selling approach also allows private equity firms to maintain a stake in high-potential companies while diversifying their portfolios. By employing strategies like partial sales or creating dedicated funds, they can optimize returns and adapt to market conditions, ensuring long-term success and sustainability.

3) Making companies better from the inside

What’s new:

There’s less focus on just “buy low, sell high” and more on improving how a company runs—things like focusing on operational efficiencies, pricing, supply chains, customer experience, and digital tools.

Why it matters:

Better operations mean stronger companies that can survive and grow no matter what’s happening in the economy. This shift towards enhancing internal processes highlights the importance of adaptability in today’s fast-paced market. By optimizing operations, companies increase efficiency and foster innovation and resilience. Ultimately, this approach leads to sustainable growth, creating a competitive edge. As firms embrace these strategies, they are better equipped to respond to market changes, meet customer demands, and navigate challenges. This proactive mindset cultivates a culture of continuous improvement, ensuring long-term success in an ever-evolving landscape. Emphasizing internal operations is key to enduring relevance and gaining a competitive edge that can withstand economic fluctuations and increase value.

4) The AI factor

What’s new:

Firms are using artificial intelligence for almost everything—finding companies to buy, checking their financial health, and even improving operations.

Why it matters:

AI can spot opportunities and problems much faster than humans, giving PE firms a serious edge. This technological advantage allows private equity firms to make more informed decisions, optimize operations, and maximize investment returns. As AI continues to evolve, its integration into the investment process will become even more crucial, reshaping the private equity landscape and enhancing competitive strategies.

5) Picking future-proof industries

What’s new:

Private equity money is flowing into areas like clean energy, healthcare technology, and specialized software—sectors expected to grow for years.

Why it matters:

Focusing on industries with long-term growth potential makes investments less risky and more rewarding. Investors are increasingly drawn to these sectors, as they align with global trends and societal needs. They can capitalize on emerging opportunities by prioritizing future-proof industries while mitigating volatility. This strategic approach enhances portfolio resilience and supports sustainable development and innovation.

6) Opening the doors to more investors

What’s new:

PE used to be reserved for big institutions and ultra-wealthy individuals. Now, new fund types and online platforms are making it easier for regular investors to invest (though usually with restrictions).

Why it matters:

It could mean more people sharing in private equity returns, but it also brings new rules and the need for more transparent communication. This shift democratizes access to private equity, potentially enriching a broader audience. However, the influx of retail investors requires education on risks and benefits. Fund managers must adapt by enhancing transparency and ensuring that investors understand the intricacies of their investments to navigate this evolving landscape effectively.

7) Protecting against new risks

What’s new:

Cyberattacks, AI misuse, and supply-chain problems are real threats. Regulators want firms and their portfolio companies to be prepared.

Why it matters:

A security breach or compliance issue can destroy value fast—prevention is now part of the business model. Firms must invest in robust cybersecurity measures and risk management strategies to mitigate these threats. Also, fostering a compliance culture and proactive monitoring will help safeguard assets. As the landscape evolves, staying ahead of potential risks is essential for maintaining stakeholder trust and ensuring long-term success.

8) Talent is the new secret weapon

What’s new:

Capital is easy to find; skilled leaders are not. Firms are building networks of proven CEOs, CFOs, and tech leaders they can quickly hire.

Why it matters:

Great people can turn a good business into a great one—faster and less risky. Organizations increasingly recognize that while financial resources are abundant, exceptional talent is scarce. By cultivating a pool of experienced executives, businesses can accelerate growth and navigate challenges more effectively. This strategic focus on talent is becoming essential for long-term success.

9) Politics is reshaping where the money goes

What’s new:

Shifts in government policy, trade rules, and regulations are steering where private equity money flows.

In renewable energy, tax credits and climate policies have made clean-energy projects more attractive, drawing billions in new PE investments.

In healthcare, regulatory changes and political debates around pricing are forcing firms to focus more on tech-enabled services and cost-efficient care rather than traditional providers.

Increased government spending in certain countries on defense and security has made these sectors hot spots for investment, especially in cybersecurity and advanced manufacturing.

On the other hand, stricter data privacy and cross-border deals rules are slowing investments in some tech companies, particularly those that handle sensitive information.

Why it matters:

Political winds can boost specific sectors while making others riskier. Firms that pay close attention to these shifts can position themselves to ride the wave—while those that don’t may be left high and dry.In addition, the evolving landscape of international relations influences global investment strategies. Investors are now more cautious about entering markets with political instability. Moreover, environmental, social, and governance (ESG) considerations are becoming critical in decision-making, driving funds toward companies with sustainable practices.

The takeaway

Private equity is shifting from “the money behind the deal” to being a partner, builder, and problem-solver. The firms that thrive will be the ones that use every tool available—finance, technology, operations, talent, and a sharp eye on politics—to grow strong, resilient companies.

In short, it’s still about making money, but the playbook is getting much more interesting. As private equity evolves, firms must embrace innovation and adaptability. Success will hinge on their ability to integrate diverse expertise and navigate complex challenges. By fostering collaboration and leveraging multifaceted strategies, they can enhance profitability and contribute to building sustainable businesses for the future.

What’s new:

Private equity money is flowing into areas like clean energy, healthcare technology, and specialized software—sectors expected to grow for years.

Why it matters:

Focusing on industries with long-term growth potential makes investments less risky and more rewarding. Investors are increasingly drawn to these sectors, as they align with global trends and societal needs. They can capitalize on emerging opportunities by prioritizing future-proof industries while mitigating volatility. This strategic approach enhances portfolio resilience and supports sustainable development and innovation.

6) Opening the doors to more investors

What’s new:

PE used to be reserved for big institutions and ultra-wealthy individuals. Now, new fund types and online platforms are making it easier for regular investors to invest (though usually with restrictions).

Why it matters:

It could mean more people sharing in private equity returns, but it also brings new rules and the need for more transparent communication. This shift democratizes access to private equity, potentially enriching a broader audience. However, the influx of retail investors requires education on risks and benefits. Fund managers must adapt by enhancing transparency and ensuring that investors understand the intricacies of their investments to navigate this evolving landscape effectively.

7) Protecting against new risks

What’s new:

Cyberattacks, AI misuse, and supply-chain problems are real threats. Regulators want firms and their portfolio companies to be prepared.

Why it matters:

A security breach or compliance issue can destroy value fast—prevention is now part of the business model. Firms must invest in robust cybersecurity measures and risk management strategies to mitigate these threats. Also, fostering a compliance culture and proactive monitoring will help safeguard assets. As the landscape evolves, staying ahead of potential risks is essential for maintaining stakeholder trust and ensuring long-term success.

8) Talent is the new secret weapon

What’s new:

Capital is easy to find; skilled leaders are not. Firms are building networks of proven CEOs, CFOs, and tech leaders they can quickly hire.

Why it matters:

Great people can turn a good business into a great one—faster and less risky. Organizations increasingly recognize that while financial resources are abundant, exceptional talent is scarce. By cultivating a pool of experienced executives, businesses can accelerate growth and navigate challenges more effectively. This strategic focus on talent is becoming essential for long-term success.

9) Politics is reshaping where the money goes

What’s new:

Shifts in government policy, trade rules, and regulations are steering where private equity money flows.

In renewable energy, tax credits and climate policies have made clean-energy projects more attractive, drawing billions in new PE investments.

In healthcare, regulatory changes and political debates around pricing are forcing firms to focus more on tech-enabled services and cost-efficient care rather than traditional providers.

Increased government spending in certain countries on defense and security has made these sectors hot spots for investment, especially in cybersecurity and advanced manufacturing.

On the other hand, stricter data privacy and cross-border deals rules are slowing investments in some tech companies, particularly those that handle sensitive information.

Why it matters:

Political winds can boost specific sectors while making others riskier. Firms that pay close attention to these shifts can position themselves to ride the wave—while those that don’t may be left high and dry.In addition, the evolving landscape of international relations influences global investment strategies. Investors are now more cautious about entering markets with political instability. Moreover, environmental, social, and governance (ESG) considerations are becoming critical in decision-making, driving funds toward companies with sustainable practices.

The takeaway

Private equity is shifting from “the money behind the deal” to being a partner, builder, and problem-solver. The firms that thrive will be the ones that use every tool available—finance, technology, operations, talent, and a sharp eye on politics—to grow strong, resilient companies.

In short, it’s still about making money, but the playbook is getting much more interesting. As private equity evolves, firms must embrace innovation and adaptability. Success will hinge on their ability to integrate diverse expertise and navigate complex challenges. By fostering collaboration and leveraging multifaceted strategies, they can enhance profitability and contribute to building sustainable businesses for the future.

Rand Manasse

Green Lane Partners

Managing Partner

914.643.8840

Leave a Reply